Property Market Analysis - August 2017

Introduction

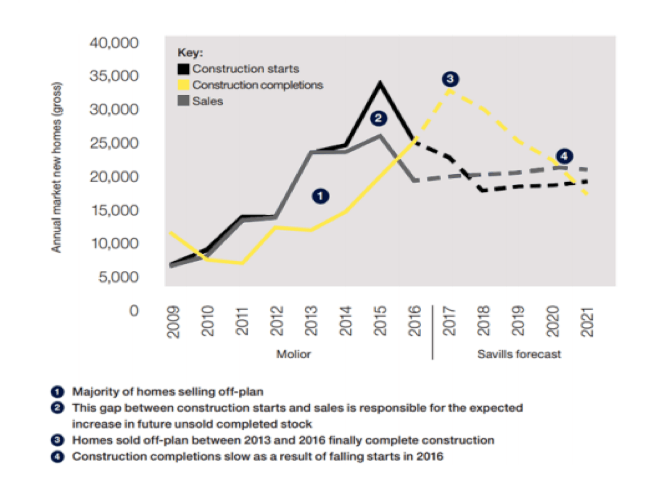

August has been an interesting month for the property investment market. The stumbling Brexit talks have left the UK’s construction industry at risk of recession which has directly impacted the number of new homes entering the market, and fewer investors are interested in putting money down for property due to increasingly slowing growth.

The number of mortgages approved is the lowest it has been this year, and the growth of the economy is half that in 2016. All of these factors combined mean that property investors in August this year saw slow growth on previous investment, though did not lose significant monies in terms of house prices – maintaining their investments for the time being.

The Wider Economy’s Effect on August’s Property Statistics

Looking at the statistics for this month, we have seen a 0.3% growth in the UK economy compared to the 0.2% last quarter, and we are on track with current predictions. Average rents across the UK also rose by 1.8% on the year which was good news. August saw the prices for central London and other cities slump by 0.1%, with a 0.1% rise in the countryside.

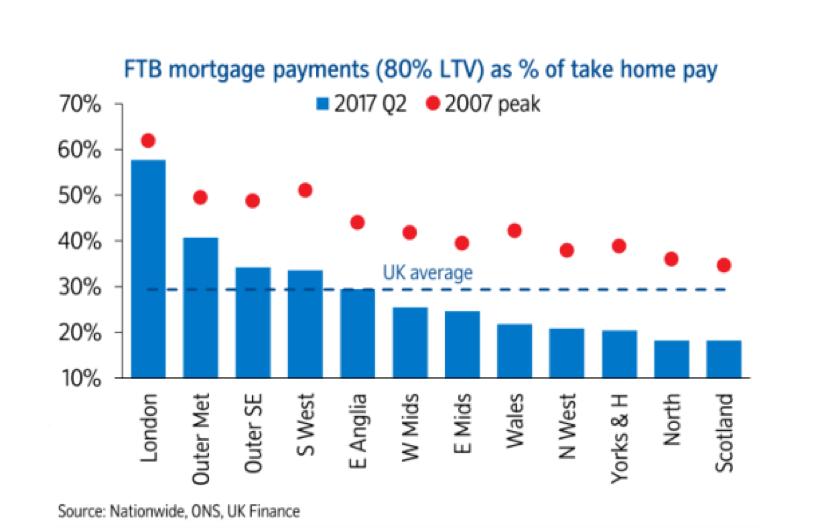

The economy has had an effect on pricing due to wages failing to keep up with the cost of living in the past few months, coupled with weakened faith in the property investment arena. That said, it has been expected that the strength of the labour market and the continued creation of new jobs coupled with an ever decreasing unemployment rate would mean that the housing market would be stimulated – especially since actual mortgage rates have decreased to the lowest they’ve ever been. The actual effect of the wider economy on the property industries has been mixed, however.

Several tax changes in 2016 have also shaken up the property investment industry, and we can still see minor repercussions in the figures for 2017.

The hike in stamp duty and the removal of interest relief for landlords has also caused the market to slow as more landlords are choosing to sell their properties as profits fall. This is still affecting us in August, though is expected to decrease throughout this winter.

The number of homes on the books of estate agents is the lowest it has been in 30 years, which is doing wonders for house prices. Due to the aforementioned construction woes there are also fewer new houses being built than ever before which means we can expect house price to be quite robust, and not suffer to severely despite recent set-backs. The house prices are continuing to rise on average, despite the percentage increase losing steam in recent months.