How You Can Prepare For Brexit NOW

Here’s Premier Property’s 5 Steps To Make Sure Your Property Investing Is BREXIT Proof

On July 23rd at 1:00pm, Boris Johnson became Prime Minister of the UK.

Whether that’s a good thing or a bad thing – YOU decide.

BREXIT IS happening.

According to Boris Johnson.

This is with or without a deal from the EU.

So, what does this mean for property investors like you?

At Premier Property, we believe in sharing information with you that can be practically used, so let’s jump straight in.

Brexit Preparation Step #1: Know Your Area

Location, location, location…

This is a phrase that has been said over and over in the property community but is one that is key to your property investing.

This may seem like a simple thing to remember, but it’s always good to be on top of your game…especially now.

Whichever area you’re thinking about investing in, make sure you go and visit your potential property first.

Property investing is very lucrative when done right, but very expensive when done wrong. (I’m sure you’ve heard of a lot of the horror stories around property).

Knowing your area plays an important part in how successful you will be as a property investor.

So when you assess your property investing area, make sure you understand the:

- Types of property

- Types of tenants

- The Streets with potential

- The Streets to Avoid

If you think about it…

One post code, is made up of so many different types of property types and ‘mini’ areas within an area. If you take your postcode for example, can you think of how the area differs from one side compared to another?

Even when it comes to property

hotspots across the UK, averaged out the hotspot may be increasing in price, but it’s an average…

Meaning there’s properties decreasing in value, stagnating, and growing rapidly.

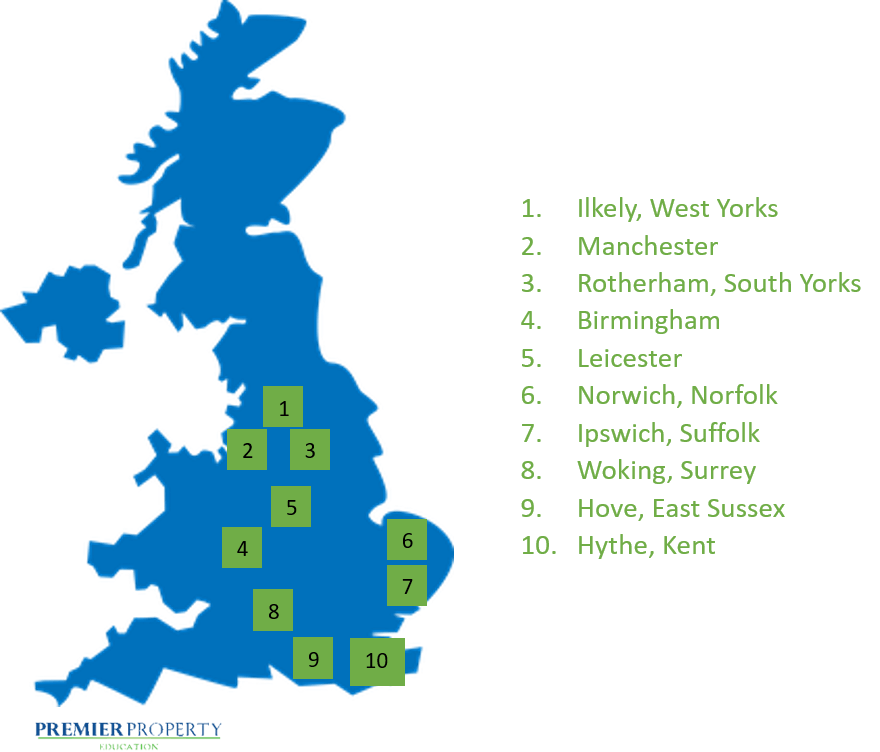

The image below shows 10 of the UKs hotspot areas for property investing right now…

An area can change over a small distance, which make a HUGE difference to your property investing.

This is something to keep in mind before BREXIT, during BREXIT and after BREXIT.

Brexit Preparation Step #2: Know How Much Your Property Is Worth

Now this is a topic people can get heated about.

A vendor (someone who owns a house) will usually overprice their house, and an investor (a good one) will offer a fair price where they can profit from the property and secure the deal for the vendor.

But how do you know how much your property is worth?

At Premier Property, we number crunch millions of pounds worth of deals each month to make sure they fit our buying criteria. We have a number of different systems to make sure we know how much a property is worth, both when we buy it, and when we are planning to exit (I’ll talk about this later).

I’ve taken one of the systems and simplified this for you below…

It’s important to remember that the property you’re buying - is it a calculated investment decision?

Or one that just looks good?

BREXIT will (most probably) affect house prices.

An easy yet effective solution to these questions is considering to value the property yourself.

So let's imagine that an estate agent is marketing a property for £160,000.

How do you work out what that property is really worth?

Stage 1

Take the asking price as a pinch of salt, let your own due diligence be the confirmation.

Now this is important.

A lot of people get carried away with the price they see on Rightmove, or a price they hear from an agent, but in reality, the price you pay for the property is one that you choose and the buyer accepts.

Stage 2

Generate a list of recent sales:

- Go to Rightmove

- Select “Sold house prices”

- Enter the property's postcode

- Set a radius of 1/4 mile

- Select “freehold” if it's a house, or “leasehold” if it's a flat

You're now looking at a list of properties that have sold nearby, with the most recent sales at the top.

Stage 3

Go through the list, using the photos and number of bedrooms to find properties that are most similar to the one you want to know the value of.

Overlook anything with a different number of bedrooms, or which is clearly not similar – like a detached house instead of a terrace, or just one that is clearly much smaller.

Now… If there are very few results, change your search radius to 1/2 mile and start again.

Stage 4

From your list of similar properties, work out the range of selling prices.

It might be that those in ordinary condition went for £160,000, those that had been extended or had a big garden went up to £180,000, and perhaps there were some damages down towards £130,000.

There will usually be some strange outliers too, which sold at a particularly high or low price for no obvious reason.

Give the most weight to properties that sold recently.

If the sale was more than a year ago, be careful because the market in general might have moved since then.

We have a tried and tested system to deal with estate agents to make sure you are always buying property at the right price.

With BREXIT around the corner, a 10% difference in price could mean £16,000 difference in price if the property is £160,000.

Now what’s important to remember is that this is just an overview desktop valuation we have at Premier Property to find the price of deals. There’s a few more systems you will need to know in order not to overpay on the property you are buying.

It’s better to get prepared now, before Brexit comes into effect.

Of course, I cannot give any tax finance or legal advice, all I am doing is sharing my perspective with you as a property investor and developer and sharing what we do here at Premier Property.

There are certain things you need to think about now… like mortgage rates and how they may change after the UK leaves the EU.

But how will this affect you?

Both a deal or no deal scenario could mean future rises or falls in interest rates depending on the economy. For example, if it’s slowing down, the government might step in and reduce interest rates to help encourage growth.

On the other hand, the government might decide to raise interest rates if inflation becomes a problem.

Brexit Preparation Step #3: Variable vs Fixed Rate Mortgages

If interest rates increase, it’s likely that mortgage rates would go up, for those not currently on fixed rate deals.

If you’re on a variable rate mortgage and you’re worried about rates rising… you may want to consider a fixed rate deal now and have the peace of mind that your mortgage repayments will not increase during the period of the fixed term.

If you’re already on a fixed rate mortgage, your interest rate would stay the same until your current mortgage runs out.

But you’ll NEED to think about what to do when your deal comes to an end.

Whatever you decide to do, it’s important to weigh up the pros and cons.

Take into consideration any exit fees you might be charged if you move your mortgage before the end of your current mortgage deal.

Most investors would take a two-year fix on mortgages... but with the lending criteria getting tighter for investors, some of the better deals in terms of loan to value can be found at a five-year fix.

No one knows exactly what will happen to the property market after the next couple of months, so plan for what will happen if circumstances go out of your control.

Brexit Preparation Step #4: Know Your Exit Plan

In property, there’s only really going to be 2 options you can choose from –

Option1: You keep your property

Option 2: You sell it.

Even you if are doing a strategy like Serviced Accommodation or Rent to Rent, you will need to keep the property (even if you do not own it), or if you are sourcing a property to pass on, technically you aren’t keeping it… so you’re selling it.

Of course, there are other creative ways to invest in property, but it ultimately falls back in to these 2 categories.

So which one will this be for you?

Now to work this out, you need to know the different strategies that are working in the property market right now…

So you can pick a property strategy that is right for you and will be for the next 12-24 months

Every property investor always talks about having a property strategy, but how do you know which one is the right one for you?

There’s a lot of noise in the property market about all of the ‘best’ strategies.

One person says do this strategy and another says do this one.

It leaves people feeling confused, unfulfilled and stops them from moving forward.

So, the question is…

How do you know what the best strategy is for you?

At Premier Property, we believe in sharing with you ALL of the strategies that are relevant to you in the property market right now (there are 10), so you can CHOOSE the one that is best suited to you.

There are 3 questions you should ask yourself when thinking about choosing a strategy

- How much money do you have to currently invest in property? Do you have a pot? Or are you starting from scratch? Work out exactly the resources you have. There are property strategies where you can literally start with nothing (yes nothing), and other strategies where you will need more of a cash input (but it doesn’t have to be your cash either)

- What is most important to you, would you like to have accelerated income now, and less capital, less income and more capital, or both? If you are more interested in maybe building an income to go part time or replace your job income, then income might be more important to you right now. If you are looking to create a pension, or leave a legacy, then it may be the capital option for you.

- How much experience do you have? And to what level would you like to start at or grow at? And there is no right or wrong. In the Premier Property community with the guidance and support we provide, we have investors who are looking to invest in one buy to let as their first project, to people who are doing multimillion pound developments for their first project. We have investors who are scaling steadily because they would like to, to others who are looking to double their portfolio sizes in a shorter space of time. The beauty is, YOU get to CHOOSE.

To learn more about how to be a successful property investor, join us here at the Property Investor Success Day in September 2019.

ON THE DAY we share with you 10 most relevant strategies in the property market right NOW; including income, cash & wealth creation strategies and also low funds & recession proof strategies.

We also share wealth mindset and there is great networking for you. To make it even more fun and relaxed, we reveal two gifts for you on the day AND we provide lunch, tea and coffee.

The only catch is that we SELL OUT regularly, so it’s best to get your tickets now.

Click here to get your FREE Ticket:

http://bit.ly/Property-Investors-Success-Day

These steps will help you to prepare for the probable result of Brexit, which is looming over the heads of UK property investors.

Brexit Preparation Step #5: Being Optimistic Is The New Approach

During times like these, it can be difficult to keep your head held high and to think positively.

Here at Premier Property, we encourage every individual to chase their dreams and to always think of fresh, new ideas to help them do this.

At every Premier Property event you attend, you will leave knowing and opening your eyes to something new, which will inspire you to go one step further to chasing your dream.

Educated and informed investors in the UK are still optimistic about investing in property despite Brexit uncertainty with two thirds being positive about investment growth and yields.

Some 64% are optimistic about the outlook for the residential buy to let sector over the next three years and of this, 13% are very optimistic

So, what are you doing to stay optimistic?

No one knows for certain what’s going to happen after the referendum – is it going to be good for you or challenging for you? – but what we do know is that staying positive will benefit you tremendously.

To make it easier for you, you can:

- Stay in the right environment, one that you like to be a part of

- Set your goals and stick to them by being held accountable

- Ask for help when you need it, property can be lonely and its best to learn from other people’s mistakes rather than make the same mistake yourself.

If you’d like to receive more tips on why you should stay positive and hopeful, check out this video published on the Premier Property Education YouTube page.

It’s about a property investors success story from with in the Premier Property Community and their journey of how they achieved success in a short space of time.

Watch the full video below now.

So, when Brexit inevitably happens, be educated, motivated, and hopeful.

Now it’s over to you!

Comment below with any thoughts you have about Brexit and how you think it will affect you. I’ll be answering your questions in the comments questions below, and if you would like me to write/video anything in particular, let me know!

All the best!

Do you want to be the next best property investor right now?

Kam Dovedi's book on How To Boost Your Pension and Income From Property provides you with the best top tips and strategies you NEED to know to be a successful property investor.

Not only will this make you feel more confident and comfortable when starting out your brand new property venture, but it will also make you feel much more prepared, equipped and at ease.

To get your FREE book now, click on the image below!